IATA Expects Net Airline Industry Losses of $47.7bn in 2021

The International Air Transport Association (IATA) expects the losses of airlines to decrease in 2021 compared to 2020, but estimates that “the pain of the crisis will continue to increase”.

In its latest outlook, the association predicts that in 2021, the net airline industry losses will reach $47.7 billion (net profit margin of -10.4 percent) – an improvement on the estimated net industry loss of $126.4 billion in 2020 (net profit margin of -33.9 percent).

“This crisis is longer and deeper than anyone could have expected… There is optimism in domestic markets where aviation’s hallmark resilience is demonstrated by rebounds in markets without internal travel restrictions. Government imposed travel restrictions, however, continue to dampen the strong underlying demand for international travel,” IATA Director-General Willie Walsh said.

Immediate priorities

In the face of the ongoing crisis, IATA calls for:

- Plans for a restart in preparation for a recovery

The association continues to urge governments to have plans in place so that no time is lost in restarting the sector when the epidemiological situation allows for a re-opening of borders.

According to Walsh, most governments have not yet provided clear indications of the benchmarks that they will use to safely give people back their travel freedom. In the meantime, a significant portion of the $3.5 trillion in GDP and 88 million jobs supported by aviation are at risk.

“With the virus becoming endemic, learning to safely live, work and travel with it is critical. That means governments must turn their focus to risk management to protect livelihoods as well as lives,” said Walsh.

- Employment support

Despite an estimated 2.4 billion people travelling by air in 2021, IATA said airlines will burn through a further $81 billion of cash on top of $149 billion in 2020. The association expects the industry to recover but underlines that more government relief measures, particularly in the form of employment support programs, will be needed this year.

- Cost containment/reduction

According to IATA, the whole industry will come out of the crisis financially weakened. “Cost containment and reductions, wherever possible, will be key to restoring financial health,” said Walsh.

Highlights of IATA’s industry outlook

Travel restrictions, including quarantines, have killed demand. IATA estimates that travel (measured in revenue passenger kilometers or RPKs) will recover to 43 percent of 2019 levels over the year. While that is a 26 percent improvement on 2020, it is far from a recovery.

Overall passenger numbers are expected to reach 2.4 billion in 2021. That is an improvement on the nearly 1.8 billion who traveled in 2020, but well below the 2019 peak of 4.5 billion.

International passenger traffic remained 86.6 percent down on pre-crisis levels over the first two months of 2021. Vaccination progress in developed countries, particularly the US and Europe, is expected to combine with widespread testing capacity to enable a return to some international travel at scale in the second half of the year, reaching 34 percent of 2019 demand levels.

2021 and 2020 have opposite demand patterns: 2020 started strong and ended weak, while 2021 is starting weak and is expected to strengthen towards year-end. The result will be zero international growth when comparing the two years.

Domestic passenger traffic is expected to perform significantly better than international markets. This is driven by strong GDP growth (5.2 percent), accumulated consumer disposable cash during lockdowns, pent-up demand, and the absence of domestic travel restrictions.

IATA estimates that domestic markets could recover to 96 percent of pre-crisis (2019) levels in the second half of 2021. That would be a 48 percent improvement on 2020 performance.

Europe

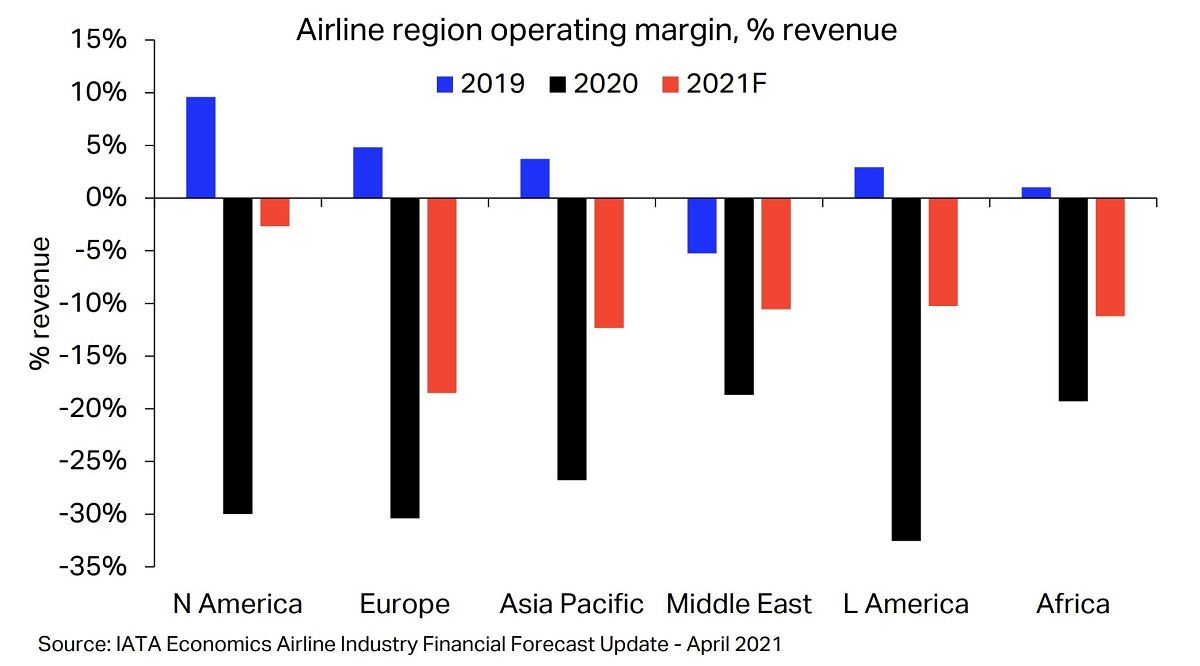

Significant differentiation is emerging between regions with large domestic markets and those relying primarily on international traffic.

Losses are highest in Europe (-22.2 billion dollars) with only 11 percent of its passenger traffic (RPK) being domestic.

Proportionately, losses are much smaller in North America (-5 billion dollars) and Asia-Pacific (-10.5 billion dollars) where domestic markets are larger (66 percent and 45 percent respectively, pre-crisis).