Greece’s Role in Shipping Threatened by Int’l Competition, EY Survey Says

Greece’s role as a global shipping center is threatened by increasing international competition and shifting world trade patterns from West to East, according to a survey released by Ernst & Young (EY) on Tuesday. EY is a global leader in assurance, tax, transaction and advisory services.

A major finding in EY’s survey, entitled “Re-positioning Greece as a global maritime capital”, which examines the country’s role as a global shipping center and explores how this role can be strengthened, is that Greek shipping has successfully coped with the crisis.

A major finding in EY’s survey, entitled “Re-positioning Greece as a global maritime capital”, which examines the country’s role as a global shipping center and explores how this role can be strengthened, is that Greek shipping has successfully coped with the crisis.

“The Greek shipping industry has weathered the storm and the Greek-owned fleet, with over than 5,272 vessels and a value approaching USD 86 billion, remains the largest in the world, in terms of tonnage capacity, and has enhanced its dominant position in terms of value, in many of the sector’s segments,” the study underlines.

The Greek flag

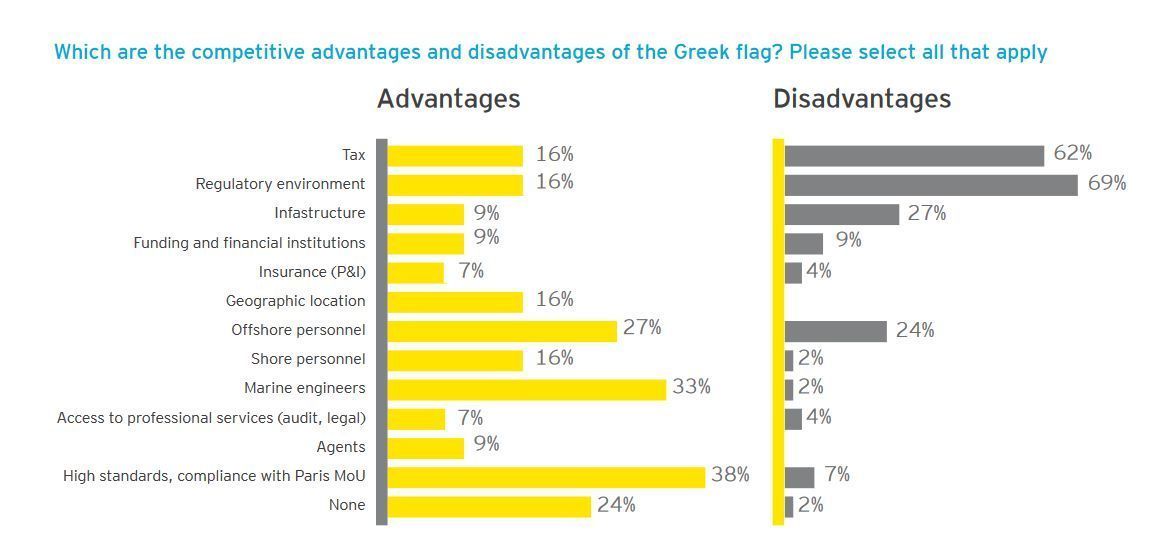

The vast majority (82 percent) own no ships flying the Greek flag, with the Marshall Islands, Panama, Liberia and Malta being the most widely used flags. Respondents did not attribute great value to the advantages of the Greek flag. Only 13 percent of the sample believed that it provides significant competitive advantages, while 45 percent disagree or strongly disagree with that statement. Although the majority of the survey’s participants do not fly the Greek flag on their ships, a full 97 percent reported that they perform at least some of their ship-management functions in Greece, of which 56 percent perform all such functions in Greece and 44 percent perform some functions outside Greece.

Although the majority of the survey’s participants do not fly the Greek flag on their ships, a full 97 percent reported that they perform at least some of their ship-management functions in Greece, of which 56 percent perform all such functions in Greece and 44 percent perform some functions outside Greece.

56% would consider relocating out of Greece

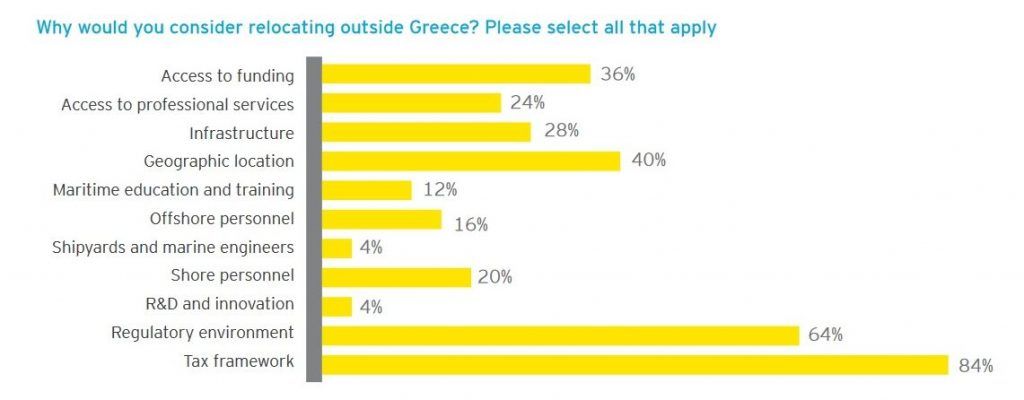

According to the EY survey, the shift of economic activity towards emerging economies in Asia and the growth of alternative maritime centers, 56 percent of the participants in the survey stated that they would consider a potential relocation of their ship-management function outside Greece, compared to 36 percent who would not.

Singapore and London are the most popular alternatives for relocation

Singapore and London are the most popular alternatives for relocation

The tax framework (84 percent) and the regulatory environment (64 percent) were once again the main reasons for considering relocation, the survey noted, adding that 52 percent among those questioned would choose to move to Singapore, while 48 percent would opt for the more traditional alternative of London. Dubai, Hamburg, New York, Hong Kong, Shanghai and Rotterdam were among their other preferred destinations.

The tax framework (84 percent) and the regulatory environment (64 percent) were once again the main reasons for considering relocation, the survey noted, adding that 52 percent among those questioned would choose to move to Singapore, while 48 percent would opt for the more traditional alternative of London. Dubai, Hamburg, New York, Hong Kong, Shanghai and Rotterdam were among their other preferred destinations.

Moreover, a full 88% of the sample believe that a potential enlargement of the Greek maritime center would be an opportunity for their business.

When questioned “How do you believe that the competitiveness of the Greek maritime centre could be improved?”, 80 percent of the respondents mentioned the need for additional maritime education and training, 69 percent asked for changes in the tax framework and access to finance and 64 percent considered the need for a regulatory environment.

Over 3,000 businesses in Piraeus and Thessaloniki

The EY survey also examined the operation and comparative advantages and disadvantages of the Piraeus and Thessaloniki shipping clusters. In Piraeus and Thessaloniki, there are a total of 3,391 businesses, including shipping companies and a number of small and medium-sized companies, mainly operating in 28 different sectors.

The EY survey also examined the operation and comparative advantages and disadvantages of the Piraeus and Thessaloniki shipping clusters. In Piraeus and Thessaloniki, there are a total of 3,391 businesses, including shipping companies and a number of small and medium-sized companies, mainly operating in 28 different sectors.

As noted in the survey, the cornerstones of the Piraeus shipping cluster are the strong presence of shipping companies, marked by their competitiveness, and their dominant position of Greek-owned fleet in the global maritime world. The port of Thessaloniki acts as a gateway port for the neighbouring Southern Balkan countries, apart from facilitating the trade flows of North Greece.

“Our country has the strongest commercial fleet in the world and a strong naval tradition. However, given the growing international competition, particularly from Asia’s emerging economies, these comparative advantages are not able alone to safeguard Greece’s role as a global shipping center,” said Yannis Pierros, Automotive & Transportation Sector Leader EY Central & Southeast Europe and Thanos Mavros, Head, Supply Chain & Operations EY Central & Southeast Europe.

Pierros and Mavros said that it is urgent to hold a national dialogue with the participation of the Greek shipping community, the State and the professionals of the Piraeus and Thessaloniki shipping clusters, aiming towards a clear strategy of support and promotion of the Greek shipping center.

“This is the only way Greece will conquer the position it deserves among the world’s maritime capitals of tomorrow,” they said.